The dead cat bounce.

The dead cat bounce.

It is a terrible term, particularly if you like cats. It’s a phrase to describe a short-lived recovery in the middle of a longer, more severe decline.

The idea behind it is that even a dead cat will appear to jump up momentarily when it falls, hitting a ledge before continuing its journey to the bottom. It’s a visual metaphor (sorry if it’s sticking in your mind) coined by ‘sensitive’ financial analysts back in the 1980s when they were describing the short-lived share price increases during the stock market’s fundamentally longer-term falls. The stock market falls were largely caused by rising interest rates and the end of cheap money that allowed businesses to stay in business while being inherently unprofitable. If you know the term, zombie businesses, you know what I’m talking about.

Those interest rate rises back then had a double effect on real estate. Firstly, as stock prices fell, people invested more in real estate, and real estate prices rose fast. But growth in asset values, when other assets are falling, can only last for so long. The real estate market turned down in 1990 and fell until 91-92. We watched many people decide they weren’t going to sell at a loss and instead choose to hang on to their properties. Sales volumes fell, but prices held over 1993 and then they didn’t.

Eventually, people realised they still really did need to sell because they needed something bigger, smaller, newer, cheaper, and so on. The market fell again between 1994 and 95. Property Economists describe this period as two separate downturns, because the upturn in the middle lasted 12 months and saw modest gains. The constant driver was high-interest rates, and property sellers and real estate agents saw the market as one long, painful correction.

What’s happening now seems very familiar.

The RBA increased the Cash Rate from 0.1% to 4.1% over the last 14 months. Real estate prices fell during 2022, and there has been modest price growth this year. A fall in the numbers of property for sale has driven growth. In actual terms, numbers of properties sold across Sydney from April 2022 to April 2023 have fallen 29.1% compared to the previous 12 months (reported by CoreLogic).

At the same time, buyer interest, as measured by Realestate.com, has almost doubled. That indicates buyers are no longer waiting for the market to fall further; they want a home now, and they think maybe the market has bottomed. And they’re right, at least for a little while. But am I the only one that’s asking, ‘If buyer interest has doubled while properties for sale have decreased 30%, why hasn’t the market gone through the roof!?’

How long this aberration lasts depends on when we have another increase in interest rates and the interest rises, we have had finally wash through the economy. And then there are the people coming to the end of fixed-interest loans. This event is constantly being talked about probably because it sounds so dramatic. And it is, particularly if you are someone going through it. The full effect on people takes about six months after they have changed to variable interest, not before. I’ve dealt with people who were forced to sell by their bank. They hold on for as long as possible, often longer than they should.

The mortgage cliff is thought to be in September this year. In that case, forced property sales will start happening in February next year or even July.

There are more than enough predictions on further interest rate increases, so I won’t argue how much they are yet to go up and why. But the thing about interest rate rises is the lag.

Many people remember 17.5% interest rates. They happened in 1990. The market didn’t really start to fall until 1991 and it didn’t stop falling until 1994 well after interest rates started to come down. People tend to think that an increase immediately causes people to change their purchase decisions. And they do, but the flow-through effects of those changed purchase decisions take time to have the biggest effect. Unemployment, recession, forced sales, tighter finance, businesses struggling, and lower pay rises or even falls in pay all take time. As Ernest Hemmingway said,

“How did you go bankrupt?”

“Two ways, gradually, then suddenly.”

But the market always has an upside and downside at the same time. The unit market property values will be more resilient. Higher interest rates always translate to higher rents. And higher rents lead to more investors buying units and holding onto the units they already have.

Houses are a different story. Land tax will continue to punish house investors. The State Government will not be willing to soften the blow as it seeks to keep its revenue coming in. The number of people buying blocks of land to build duplexes has remained high. Any decent block of land for sale has just as many duplex builders as home buyers at their auctions. That will change as the margins get tighter and banks become more cautious.

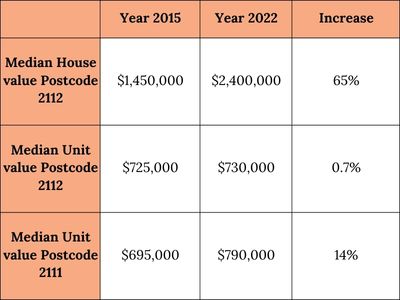

From 2015 to 2022, houses rose far more in value than units.

The reason for the disparity in unit values between 2112 and 2111 postcodes is because of the volume of new units built in Ryde which has distorted/overwelled the median values.

If you own an older unit (over 30 years) then 2111 postcode is probably a better guide. If you own a unit that is relatively new then you’ll be more like the 2112 postcode.

Yes, that hurts if you own a unit. You’ve done well if you own a house and owner-occupiers own most houses. The trouble for owner occupiers is that you must sell and downsize to get your hands on the profit, which is many years away for most of us. The next few years will probably see some level of correction, with units doing better than houses. But then possibly, they won’t. It might not sound like it from this market update, but the more I watch people and real estate, the less I think I know.

Author: Stephen Jackson